When you arrive in Spain, do your due diligence with personal finances. Make sure you will have access to your funds. Avoid getting your cards frozen due to suspected fraud, and don’t waste your money with expensive money exchange issues when converting dollars to euros.

Ensure that you have a plan and understand how to best use your money while in Spain. To do this, I have information below on how to plan your first days of finances.

Ojo! You need to open a Spanish bank account, not an American or Canadian account from a Spanish bank.

European bank accounts, regardless of the bank, use a different system altogether.

(IBAN and Swift Numbers)

Table of Contents

- First Day Finances

- Why Do I Need a Spanish Account?

- Spanish Banking Options for Foreigners

- Receiving Your Stipend & International Transfers

First Day Finances

Before you travel to Spain, inform your bank and credit card provider(s) that you are going to travel to Spain. This is to avoid them locking your account due to suspected fraud. Ask and make sure that you won’t receive additional foreign transaction fees for using your card in Europe. Also, ask your bank about international ATM withdrawal charges. It’s okay if they charge a small fee since it is usually much cheaper than ordering euros before your flight.

Please, do not carry hundreds of euros with you when you move to Spain. It is typically much more costly to order euros before your flight than it is to accept the ATM fee when you arrive in Spain. Additionally, it is a risk to carry a lot of money when travelling.

On the first day when you arrive in the airport, find an ATM and make a withdrawal using your bank card. Again, make sure you are aware of any international ATM withdrawal charges. Try to avoid paying with cash and pay with credit card instead for whatever you need. Later that day or the following day, open a Spanish bank account using your passport and NIE.

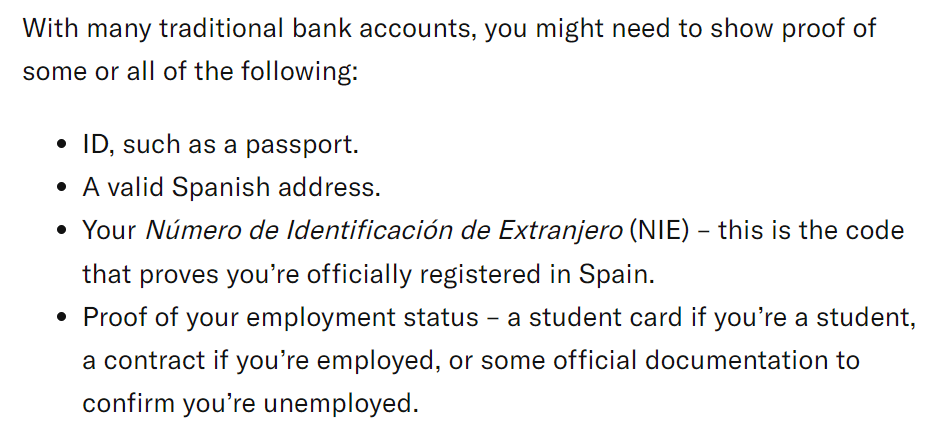

Here is a list of some general requirements that most traditional banks require:

It’s a bit of a Catch-22 situation. To get an apartment, you’ll need to pay the deposit and first month’s rent. To pay this, you’ll most likely need a Spanish bank account. To get a Spanish bank account, you need a Spanish address. Don’t worry, this isn’t an issue. There are 3 options.

Option 1: Open an online banking account that provides a Spanish IBAN. N26 is an online bank that is quite popular with people living abroad. Opening a Spanish bank account with N26 is easy, and it is able to meet all the requirements needed to receive your stipend and make domestic transfers. Instead of a physical card, you will receive a virtual Mastercard, but if you are old school, you can still pay a one time fee of 10 euros for a physical card.

You will still need a Spanish address. For this, you can either use your temporary accomodation’s address or your school’s address (and later on change it in the app), or use your rental address if you’ve already finished that step. Please wait until entering Spain to open an account.

What are the benefits?

- It’s simple to open and close and doesn’t require you to visit a physical bank nor does it require you to manage the process in Spanish.

- It’s functional. You can receive your stipend, withdraw money from any ATM up to 2 times a month for free, and make free domestic transfers.

- They provide customer support in English, so if there are any issues, it can be resolved in your native language.

- They now provide an interest rate on your savings account which is something you won’t find in most Spanish banks.

I highly recommend it due to its simplicity and functionality. If you plan on using N26, you can follow a simple guide to open the account and get everything you’ll need.

Option 2: Ask your coordinator if you can temporarily use the school address to open an account. If they say yes, great! You can open an account that day and make an international transfer. You can open any number of Spanish bank accounts or an online banking account that provides a Spanish IBAN. As soon as you get an apartment, update your bank account with your new address. If not, you have other options.

Option 3: If you are unable or unwilling to open a bank account with a temporary address, you will have to get an apartment before opening a bank account.

Apartments, Temporary Accommodation, and WIFI

For the first month’s rent, deposit, and additional fees, you can pay in cash, make a transfer using a cash deposit at the landlord’s bank, or make a transfer using an online service with your domestic bank account (consider Wise, link below). After getting an apartment, you can bring the rental contract or a paid utility bill in your name along with your Carta de Nombramiento and passport to open a bank account.

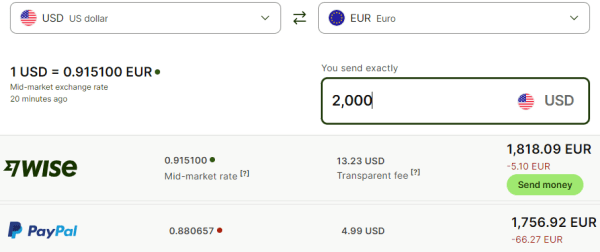

After opening your account, you need to add funds to it. Be mindful when choosing your international transfer service. Too many auxiliaries get ripped off by either their local banks, PayPal, or other familiar transfer services. When making an international transfer, please be mindful of the exchange rate and the fees.

Too many transfer services offer low fees but absolutely kill you in terrible exchange rates. It’s like being charged a massive hidden fee for each transaction. You want to get the maximum amount of euros possible for your dollars. Before you make a transfer, do a quick comparison.

For all your international transfers, I highly recommend using Wise. It is what everyone living abroad uses because it has lower fees, higher transparency on costs, and reliable, fast transfers. If you don’t believe me, check for yourself.

Once you have a bank account with funds, you will be all set to make whatever purchases or ATM withdrawals you need to by using the account’s debit card.

Why Do I Need a Spanish Bank Account?

Opening a Spanish bank account should be one of the first things you do when arriving in Spain.

You need a Spanish bank account for the following:

- Receiving the monthly stipend from your school.

- Acquiring an apartment and paying rent. Some landlords prefer cash payments and allow cash payments/deposits, but having a Spanish bank account will offer you more options when searching.

- Paying for utilities. Not all renting agreements require you to pay utilities but the majority will. You may be required to put the utilities in your name. These utilities will be paid via card or bank payment.

- Getting a phone contract if you don’t want to use a pre-paid plan.

It can be difficult to get a Spanish bank account as soon as you arrive in Spain, especially because foreign banks aren’t always happy to take American clients. America is a unique country in that it requires its citizens to file for taxes every year regardless of your residency. Because of this requirement, foreign banks are obligated to work with the IRS and follow additional American regulations. This can be a lot of extra work for banks, but every auxiliar so far has been able to get a Spanish bank. Further down in the page I will include a list of Spanish banks that will let you open up an account without yet having your residency card.

What makes Spanish bank accounts different from my account?

To make money transfers, American accounts use a routing number to identify the bank alongside an account number to identify the individual bank account (Canada uses a similar system with a transit number and institution number). Spanish accounts, along with most of the world, use the IBAN system. It’s a 2 in 1 sequence of letters and numbers that identifies the bank and the individual bank account. Because of this difference, it is a hard requirement to get a Spanish account while in Spain.

For international transfers, you might need to know your SWIFT/BIC code. For N26, this information can be found by clicking “Account Details”.

“A BIC is sometimes called a SWIFT code, SWIFT BIC or SWIFT ID (all of these mean the same thing). A SWIFT/BIC consists of 8-11 characters used to identify a specific bank in an international transaction, to make sure the money is going to the correct place.”

-Wise.com

Your bank’s SWIFT/BIC code is not specific to your bank account. It is specific to the bank itself. For example, the SWIFT code of Sabadell is BSABESBBXXX. To find out your SWIFT/BIC code, simply input your bank’s information in the following link. For some banks, the SWIFT/BIC code is shown in the app alongside your IBAN.

What is Bizum?

When going out with Spanish friends, you may be asked to make a Bizum transfer. Bizum is a free service provided by many banks including N26. With Bizum, you are able to make domestic transfers with just the recipient’s phone number. It’s basically the Spanish version of Zelle. If you want to stay old school and use cash when splitting the bill, that’s fine too, but Bizum can be incredibly convenient.

Spanish Bank Options for Foreigners

Quick tips for those using a Spanish bank:

1. Avoid keeping too much money in your accounts. Although not necessarily common, many banks in Spain can and will freeze your accounts when your TIE expires.

2. Do not pay fees to open a bank account or maintain your account. Some accounts will provide service fees or will ask you to pay a fee up front. You have many options to choose from, so find one that does not charge you. You may have to visit different banks.

3. When opening an account, you may find that the bank asks you to come back at a later time or day. It is typical to have limited hours at a branch when new bank accounts can be made. Be proactive and flexible. You may have to go to multiple branches or come back at a later time.

This is why many Auxiliar participants are now using online banking options like N26

“In some banks, a temporary bank account may be open without a NIE by presenting the passport or equivalent identification document and the Letter of Appointment. However, you need to remember that obtaining a NIE is necessary in order to participate in the program and live in Spain. When opening the Spanish bank account, it is important that you specify that you will receive a monthly stipend through an educational program. This will help to avoid commission charges. Most banks charge fees for maintaining accounts and sometimes could freeze them if no movements are made.”

-NALCAP official guidebook

N26: N26 is a unique banking option that I currently use. It is an online bank founded in Germany in 2013 that can offer you a Spanish IBAN. This type of bank account was recommended during the NALCAP Webinar. I recommend opening the free standard account.

This account is able to meet all the requirements needed for receiving your stipend. You’re able to make free domestic transfers and manage your account online with your phone. You’re also able to make 2 free ATM withdrawals a month from any ATM with the standard account.

Pros: easy to set-up and close an account, access to Bizum and can make free domestic transfers, no maintenance fees, provides a Spanish IBAN without much paperwork, free ATM withdrawals, and they don’t have a record of freezing accounts.

Cons: No physical offices, but unless you plan on applying for a mortgage, that’s not really an issue.

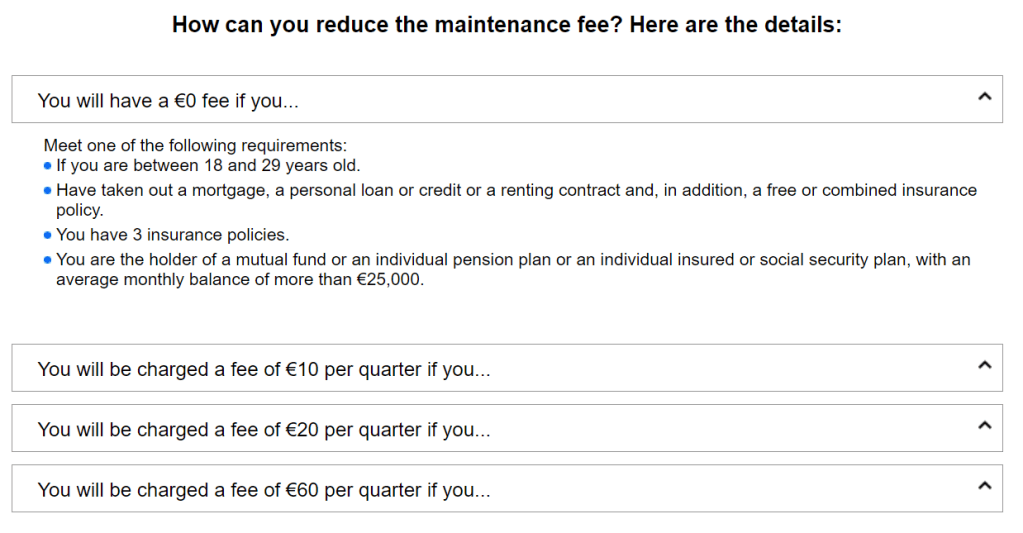

Banco de Sabadell: I personally had Sabadell which only required a passport to open an account. There are plenty of ATMs where I lived in Madrid. If you get the mobile app, you can make domestic transfers for free without limits. On the app you can easily track your spending and maintain a budget. A huge con of Sabadell are the quarterly maintenance fees. If you do not qualify for €0 maintenance fees, I do not recommend Sabadell. The conditions for €0 maintenance fees are below. You only need to meet 1 condition to qualify.

If you are between 18 and 29 years old, you won’t receive any maintenance fees for having a Sabadell account. It’s great if you fall within the age range and don’t plan on staying with the same bank until you are 29+.

Banco Santander: Being the largest bank in Spain, Banco Santander always has a physical branch close to wherever you might be in Spain. They don’t charge fees, and their app is very convenient with a great user interface.

Other Banking Options

Receiving Your Stipend & International Transfers

For most auxiliary teachers, you will need to provide your school or region with your bank details to receive the monthly stipend. All you have to do is provide the requested details in a form when requested.

Some auxiliary teachers will have a ministry placement, and those teachers will need to add their bank details online through Profex. (You will know if you have a ministry placement. You will be sent instructions on what to do via email.)

If you found the website useful, please Support the Page. Every little bit helps.

Back to Navigation

The information on http://www.residency2spain.com is provided in good faith and is intended for general informational purposes only. Residency2spain makes no guarantees regarding the accuracy, reliability, or completeness of the content. Any decisions you make based on the information found on this site are made at your own discretion and risk. Residency2spain is not liable for any loss or damage resulting from the use of this website.

Copyright © 2022 Residency2Spain All rights reserved.

-

The Future (or End) of the NALCAP Program

Restructuring of the program, multi-million euro fines, and a delay to the application window! Expect major changes to the NALCAP program. If you’d like to keep up-to-date on what’s happening, you can joinMy Auxiliary Facebook group. In 2025, the region of Andalucia was fined by the central government for a failure to pay social security…

-

A Podcast?

I’d like to share the podcast I have just started with my audience. it’s called Immigrant, not Expat. My goal is to share stories about immigration to hopefully remove the negative connotation surrounding the word “immigrant”. I am deliberately avoiding the word “expat” because I don’t want to reinforce a caste system for immigration. I…

-

Culture Shock!

People who talk about moving to another country may emphasize how different the culture will be and how to deal with culture shock. Spain is a modernized, western country that isn’t too different from the U.S, so in my experience, “shock” isn’t a great way to describe it. There are some differences, though. Most of…

-

250k Views – Day in the Life

The last time we celebrated a view benchmark, I made a post about myself and what led me to create a life in Spain. Now that we’ve hit 250,000 views, I’m posting feet on main! (Open the full image if you are a sicko). Well, the idea of this post is to share a typical…

-

Santiago de Compostela

On an extended weekend, thanks to a public holiday, my partner and I went to Santiago de Compostela. It’s a beautiful city in the northwestern region of Galicia, which is known for its rainy climate and delicious food. Santiago is an interesting city with a unique history. It is the destination of multiple pilgrimage routes…

-

Extra Income – Teaching Online

There are countless ways of saving money while in Spain, but if you want to be able to travel more and enjoy more experiences, increasing your income is a great way to do that. As native speakers of English with experience teaching English as a foreign language in Spain, your teaching services will be in…

-

Saving Money and Being Environmentally Friendly

You don’t need your own terrace garden like me, but you can easily save money and be better for the environment when living in Spain. One of the joys of moving to Europe is that it becomes possible to be environmentally friendly without sacrificing your lifestyle or money. When I lived in Indiana, I remember…

-

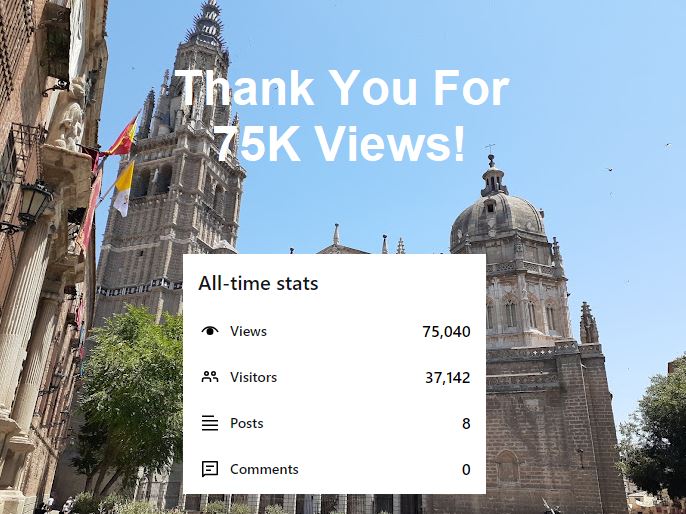

Celebrating 75,000 Views – My Journey to Spain

When I first started writing this blog, I never expected getting this type of interest. I just wanted to create something to help others find their lives in Spain and avoid the uncertainties and anxieties that plague bureaucratic processes here. It’s still only a hobby instead of being my actual job, but a lot of…

-

Spanish and U.S. Library Cards

Getting a U.S. library card before leaving for Spain and a Spanish library card while there can provide wonderful (free) services. Libraries have modernized. They provide a wide range of services that can be accessed from anywhere in the world: eBooks, audiobooks, as well as online magazines and newspapers. Individuals travelling to or living in…

-

How I Accidentally Became an Actor in Spain

“Quiet on set, roll cameras, and action!” I desperately choke for breath while grasping at my wounds. With a WW2-era revolver aimed at the entryway of an abandoned farm shed, I am slowly bleeding out while waiting for my enemies to finish me off. Suddenly, I hear noises just outside. It sounds like footsteps, and…

-

NALCAP Webinar 2022 – Highlights

July 28, 2022 Will new regulations affect auxiliares who receive supplemental income in Spain? What should I do before leaving for Spain? How do I find an apartment? What steps should I take first when I arrive in Spain? The 2022 NALCAP webinar covers topics that can help new auxiliaries and returning auxiliaries. Find out…

-

Fun Trips around Madrid

Cercedilla Cercedilla is a mountainside municipality Northwest of Madrid. It is about an hour train ride away with the cercanía trains from Atocha (the main train station). The mountainside is filled with nature, flowers, and there is a small ranch with a herd of cows living their best lives grazing on the mountainside. The cows…

-

Budgeting in Spain

The cost of living is much cheaper in Spain, but the salaries are also much lower. How do I budget? What should I expect to spend and save? Just like the U.S, some places in Spain are more expensive than others. Madrid is one of the most expensive cities in Spain, so if you live…

-

The debate of the century: with or without onion.

Spanish tortilla is a traditional dish in Spain similar to an omelette. It has eggs, potatoes, and sometimes diced onions. In Spain people are passionate about food, especially traditional food, and there is a fierce debate in Spain about which type of tortilla is better: with or without onions. Traditionalists will claim that putting onions…

-

So, you want to move to Spain?

There are many reasons to want to live in Spain. The climate is warm and pleasant. The natural landscapes are breathtaking, and with a guaranteed 22 vacation days a year, you have the time to enjoy them. Culturally, Spanish people are kind, welcoming, and outgoing. This generosity also includes the public services offered. Spain has…