Spain has a comprehensive pension system that covers basic expenses for everyone that meets a few basic requirements. It is available for anyone who has worked and paid social security in Spain for a set amount of years and is above the retirement age (subject to changes…unfortunately).

For this reason Spanish citizens are generally clueless when it comes to investing and saving for retirement. They don’t have to invest! But times are changing. Investing is growing increasingly important for everyone.

Why You Should Invest

USA vs. Spain

Investing as an Expat

Disclaimer: The content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice.

Why You Should Invest

There are many good reasons for you to invest even if you plan on taking advantage of Spain’s pension system.

Reason 1: Prices go up, salaries do not. Somehow, even though the average yearly salary in Spain is around 25,000 euros, housing prices have skyrocketed. I was shocked when I saw that a basic apartment in Seville would cost more than my parents’ retirement home in the Midwest.

For a basic 2 bedroom 2 bathroom apartment with outdated décor located in Andalucía, you could spend the entirety of your disposable income for your entire working life.

Andalucía is one of the poorest regions in Spain, so it’s difficult to even get the average salary, especially as an immigrant.

Reason 2: The retirement age keeps increasing. You can retire earlier than the retirement age, but you will be subject to a % penalty on your pension. If you have healthy investments, you wouldn’t have to work until the retirement age. You could rely on your investments + the reduced pension.

Reason 3: The future is uncertain. America definitely does not have a comprehensive pension program that will pay for all your expenses. If you end up in a situation where you need to return to the U.S, you would be starting your retirement savings from zero without proper investments.

Puppies: that was depressing. Here are some puppies!

USA vs. Spain

Historically, the U.S. economy is just better, and so historically, your U.S. based investments would go much further.

Here is an example. The S&P 500 is a stock market index that tracks the stock performance of about 500 high-value companies in the U.S. such as Amazon, Apple, and Google. It is considered a marker of the U.S. economy and its performance.

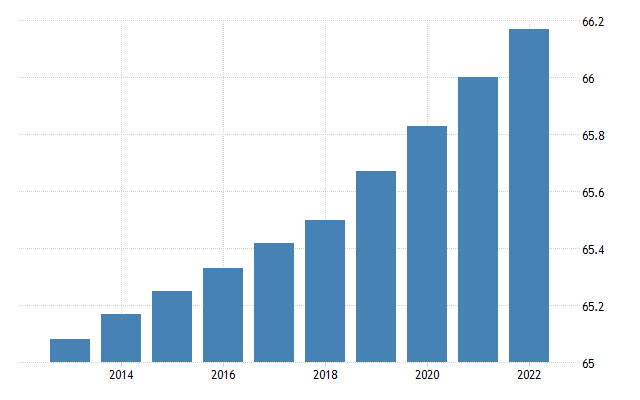

The graph for the S&P 500 begins in 1983 and ends in 2023 (40 years). Within those 40 years, it has increased by 2,500%!

40 years would be a typical length of period for someone to invest before retirement. If you invest $40,000 in 1983 and literally do nothing for 40 years, you will have 1 million dollars by the time you retire. This does not include dividend payments (money you receive for owning certain stocks).

The IBEX 35, just like the S&P 500, is representative of Spain’s economy. It is an index of Spain’s principal stock exchange. The difference in performance speaks for itself. Within the last 20 years, its value has increased by 11%. $40,000 + 11% = $44,444.

This is why I invest in the U.S. and will continue my investments in the U.S.

My investment strategy is quite boring. I invest in the S&P 500 and the total U.S. stock market through Vanguard Index Funds.

It can be difficult, but I try to invest and forget about my investments. The absolute worst thing you can do is make an emotional decision. In fact, above in the S&P 500 graph, you can see a large dip from Covid-19. A lot of people sold when stock values decreased, but it has more than recovered since then.

Investing as an Expat

Your job in Spain won’t offer a 401k or a retirement package.

Even though you must file taxes in the U.S. every year, you might not have taxable income. You might make too little or your tax obligation in Spain might exempt you from further payments. This would disqualify you from IRAs as well.

“To contribute to a traditional IRA, you, and/or your spouse if you file a joint return, must have taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment.”

https://www.irs.gov/taxtopics/tc451

How would I invest then?

If you are a U.S. citizen with a U.S. address such as your parents’ home, you can open and maintain an online brokerage account. A U.S. brokerage account would allow you to invest in U.S. index funds and stocks.

Unfortunately, many U.S. brokerage firms will not work with people living abroad. They may ask you to move your account if they find out about your foreign status, but there are still many U.S. options available.

“…U.S. expatriates may keep their US brokerage accounts and related investment accounts, such as 401k’s, Individual Retirement accounts and so on. In fact, we recommend that US citizens living abroad should keep their liquid investments in the United States. Selling them in order to move into foreign accounts could entail large capital gains tax, and distribution penalties and regular income tax if you liquidate and distribute your retirement accounts.”

Can’t I use a foreign broker? Yes you can, but there are extra rules and regulations that can apply to a U.S. citizen investing abroad. One big reason for these extra restrictions is that the government doesn’t take too kindly to citizens who hide assets abroad.

Nardisadvisors – Compliance with Reporting of Foreign Assets

The specific U.S. brokerage or trading platform you use is not so important (of course, make sure it is a legitimate company insured by the U.S government).

Buying stocks is not like buying fruit at the market. Apple stocks are Apple stocks. They are not better across the street or at a different market. Identical stocks and funds will perform the same between brokerages.

What is important is that you understand the user interface, have the options you want, and do not pay extra fees.

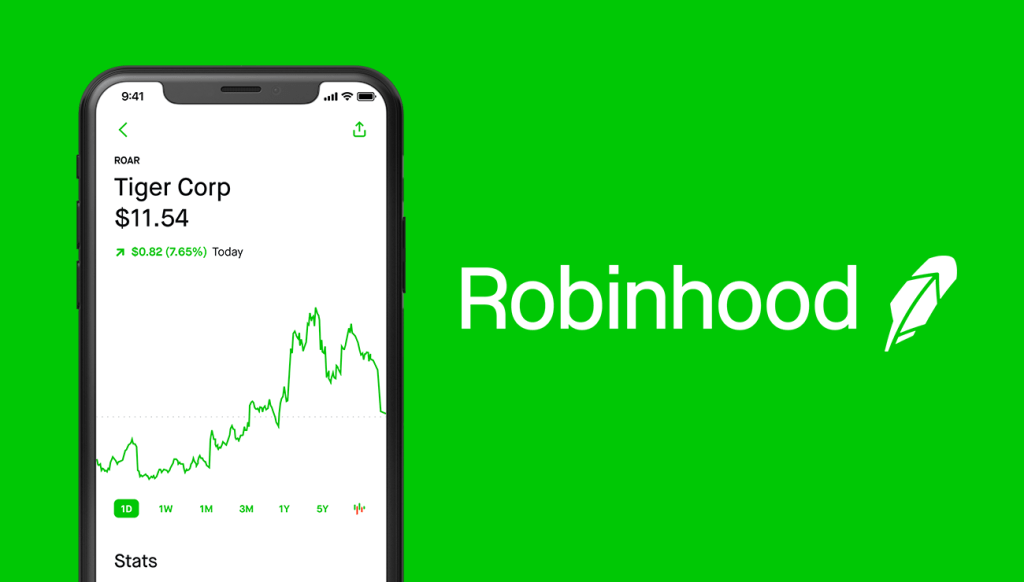

I use Robinhood since it hasn’t given me issues as someone living abroad. The app is easy to understand. It has extra options such as dividend reinvestment, so I can completely forget about my investments because my dividends are automatically reinvested. Most importantly, there are no extra fees.

You can sign up completely online for free, and if you use my sign up link, you will receive up to $200 in free stock.*

Online investment platform. Free sign up. No extra fees. Available for individuals based in the United States. Accessible from almost anywhere.

*You are free to sell the stock within 3 business days and withdraw the money from that sale after 30 calendar days.

Regardless of the brokerage or trading platform you use, it is important to invest and set yourself up for a healthy financial future. You don’t have to be rich or even have a good income to invest.

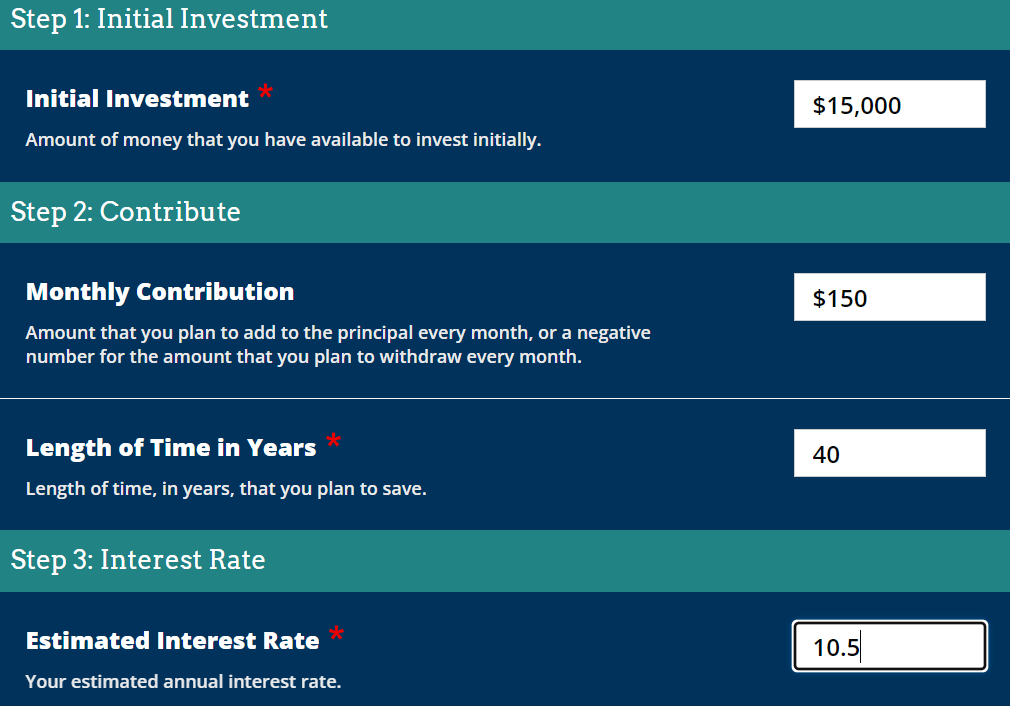

If you’re curious, you can use an online investment calculator to imagine your future finances. I do this as well.

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Just a small monthly contribution grows quickly with the help of compound interest.

You will see a very pretty number after hitting calculator, but just remember that your investment returns are not tax free.

If you found the website useful, please Support the Page. Every little bit helps.

Back to Navigation

The information on http://www.residency2spain.com is provided in good faith and is intended for general informational purposes only. Residency2spain makes no guarantees regarding the accuracy, reliability, or completeness of the content. Any decisions you make based on the information found on this site are made at your own discretion and risk. Residency2spain is not liable for any loss or damage resulting from the use of this website.

Copyright © 2022 Residency2Spain All rights reserved.

-

The Future (or End) of the NALCAP Program

Restructuring of the program, multi-million euro fines, and a delay to the application window! Expect major changes to the NALCAP program. If you’d like to keep up-to-date on what’s happening, you can joinMy Auxiliary Facebook group. In 2025, the region of Andalucia was fined by the central government for a failure to pay social security

-

A Podcast?

I’d like to share the podcast I have just started with my audience. it’s called Immigrant, not Expat. My goal is to share stories about immigration to hopefully remove the negative connotation surrounding the word “immigrant”. I am deliberately avoiding the word “expat” because I don’t want to reinforce a caste system for immigration. I

-

Culture Shock!

People who talk about moving to another country may emphasize how different the culture will be and how to deal with culture shock. Spain is a modernized, western country that isn’t too different from the U.S, so in my experience, “shock” isn’t a great way to describe it. There are some differences, though. Most of

-

250k Views – Day in the Life

The last time we celebrated a view benchmark, I made a post about myself and what led me to create a life in Spain. Now that we’ve hit 250,000 views, I’m posting feet on main! (Open the full image if you are a sicko). Well, the idea of this post is to share a typical

-

Santiago de Compostela

On an extended weekend, thanks to a public holiday, my partner and I went to Santiago de Compostela. It’s a beautiful city in the northwestern region of Galicia, which is known for its rainy climate and delicious food. Santiago is an interesting city with a unique history. It is the destination of multiple pilgrimage routes

-

Extra Income – Teaching Online

There are countless ways of saving money while in Spain, but if you want to be able to travel more and enjoy more experiences, increasing your income is a great way to do that. As native speakers of English with experience teaching English as a foreign language in Spain, your teaching services will be in

-

Saving Money and Being Environmentally Friendly

You don’t need your own terrace garden like me, but you can easily save money and be better for the environment when living in Spain. One of the joys of moving to Europe is that it becomes possible to be environmentally friendly without sacrificing your lifestyle or money. When I lived in Indiana, I remember

-

Celebrating 75,000 Views – My Journey to Spain

When I first started writing this blog, I never expected getting this type of interest. I just wanted to create something to help others find their lives in Spain and avoid the uncertainties and anxieties that plague bureaucratic processes here. It’s still only a hobby instead of being my actual job, but a lot of

-

Spanish and U.S. Library Cards

Getting a U.S. library card before leaving for Spain and a Spanish library card while there can provide wonderful (free) services. Libraries have modernized. They provide a wide range of services that can be accessed from anywhere in the world: eBooks, audiobooks, as well as online magazines and newspapers. Individuals travelling to or living in

-

How I Accidentally Became an Actor in Spain

“Quiet on set, roll cameras, and action!” I desperately choke for breath while grasping at my wounds. With a WW2-era revolver aimed at the entryway of an abandoned farm shed, I am slowly bleeding out while waiting for my enemies to finish me off. Suddenly, I hear noises just outside. It sounds like footsteps, and

-

NALCAP Webinar 2022 – Highlights

July 28, 2022 Will new regulations affect auxiliares who receive supplemental income in Spain? What should I do before leaving for Spain? How do I find an apartment? What steps should I take first when I arrive in Spain? The 2022 NALCAP webinar covers topics that can help new auxiliaries and returning auxiliaries. Find out

-

Fun Trips around Madrid

Cercedilla Cercedilla is a mountainside municipality Northwest of Madrid. It is about an hour train ride away with the cercanía trains from Atocha (the main train station). The mountainside is filled with nature, flowers, and there is a small ranch with a herd of cows living their best lives grazing on the mountainside. The cows

-

Budgeting in Spain

The cost of living is much cheaper in Spain, but the salaries are also much lower. How do I budget? What should I expect to spend and save? Just like the U.S, some places in Spain are more expensive than others. Madrid is one of the most expensive cities in Spain, so if you live

-

The debate of the century: with or without onion.

Spanish tortilla is a traditional dish in Spain similar to an omelette. It has eggs, potatoes, and sometimes diced onions. In Spain people are passionate about food, especially traditional food, and there is a fierce debate in Spain about which type of tortilla is better: with or without onions. Traditionalists will claim that putting onions

-

So, you want to move to Spain?

There are many reasons to want to live in Spain. The climate is warm and pleasant. The natural landscapes are breathtaking, and with a guaranteed 22 vacation days a year, you have the time to enjoy them. Culturally, Spanish people are kind, welcoming, and outgoing. This generosity also includes the public services offered. Spain has